Commentary: Chinese e-commerce giants were prepared for tariffs, but not like this

Major e-commerce platforms like Shein and Temu will be hit by Donald Trump's one-two punch of steep tariffs on China and the end of tax-free status for low-value parcels, says Momentum Works’ Li Jianggan.

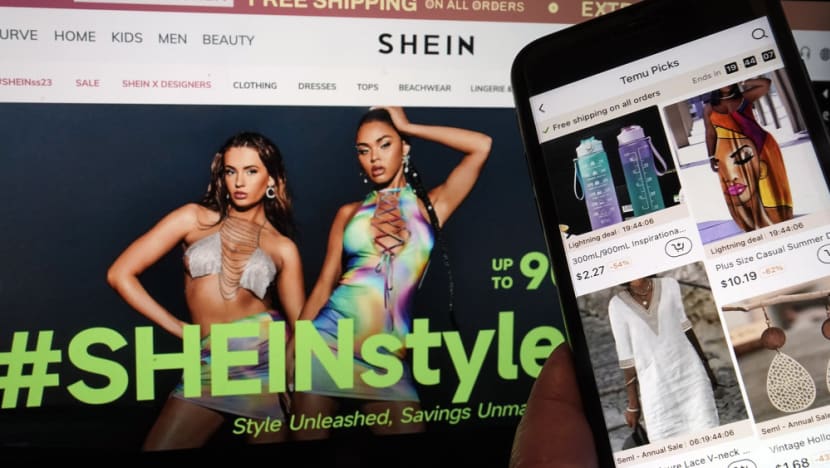

FILE - Pages from the Shein website, left, and from the Temu site, right, are shown in this photo, in New York, June 23, 2023. (AP Photo/Richard Drew, FIle)

This audio is generated by an AI tool.

SINGAPORE: “Total chaos.” A friend who heads a cross-border e-commerce logistics company told me what happened on the ground in February – the last time United States President Donald Trump tried to end the de minimis exemption that allowed parcels valued US$800 and below to enter the US tax-free.

Scheduled cargo planes failed to depart from China to the US; goods that had been flown in piled up at customs, as were the halls with people – like my friend, many companies had sent employees out to deal with the mess. Add on the 10 per cent extra tariff on Chinese imports Mr Trump had ordered to effect on the same day, and logistics companies did not know how and how much to charge their client.

That policy change was paused on Feb 5, after slightly more than 24 hours it came into effect, during which the authorities and US Postal Service (a major delivery player of low-value parcels) made a lot of sometimes conflicting changes and U-turns.

Low-value parcels from China are now set to lose their tax-free status more definitively from Friday (May 2), an order made on Mr Trump’s so-called “Liberation Day” when he slapped tariffs on all trading partners.

With Chinese imports to the US tariffed at 145 per cent and the converse at 125 per cent, many trades between the two have been rendered economically unviable.

And caught in the middle of the waiting game to see who will be the first one to blink are Chinese ecommerce platforms, notably Shein and Temu, and US consumers.

E-COMMERCE PLATFORMS SAW THIS COMING

The leaders of major platforms and logistics companies have been clear-headed all this while. They cannot afford not to, with billions of low-value shipments to the US.

The end of de minimis rule would come – they saw that coming long before Mr Trump started his second term. The February chaos was simply a dry run, or even a deliberate stress test.

In fact, the challenges they anticipated went far beyond their parcels costing more because of the nominal tariffs levied.

To understand why, remember that e-commerce is a game of four core consumer value propositions: selection, quality, speed and savings.

In different ways, the Chinese cross-border platforms focused on presenting a vast selection to US (and other countries’) consumers at very cheap prices. Compared to traditional forms of import and retail, Shein and Temu cut off multiple layers of intermediaries and reduced inventory risks and costs by going directly to the manufacturers.

The trade-off consumers in the US and elsewhere will face is speed. Instead of getting goods instantly in hand from nearby stores or with next day delivery from platforms like Amazon, consumers wait for a week or more for a parcel to arrive from China.

They live with it because of the price advantages. Now that costs will go up and customs clearance adds more delays and uncertainty, will consumers still be willing to wait?

MITIGATION MEASURES OVERWHELMED BY TARIFF SALVO

Since last year, both Shein and Temu have been actively preparing for the potential loss of the de minimis treatment.

Temu actively diverted its growth attention away from cross border to goods that are shipped from domestic warehouses in the US. It has also been actively reducing its exposure to the US market by diversifying, growing volumes in markets like Europe, Korea, Japan and Latin America.

Shein has been actively diversifying its ecommerce supply chain, including in Mexico and Brazil. We have also met Shein suppliers who have been building factories in Turkey and Morocco.

After the chaos in February, one platform also encouraged its Chinese suppliers to shift manufacturing to Vietnam and started to build logistics capabilities there. Another platform has been shipping more than 10,000 parcels a day to the US from a third country.

Nonetheless, the magnitude and widespread coverage of US tariffs took everyone by surprise. Shipping from a third country, or even moving the supply chain, is now less safe than it used to be.

WHAT’S NEXT FOR SHEIN, TEMU?

The global supply chain will always find its way to adapt to whichever shock that is thrown to it, or whichever drastic change that becomes permanent.

If high prices become permanent, consumers will adapt as well, eventually.

Logistics experts and economists warn that Mr Trump’s tariffs will mean higher prices and emptier store shelves for US consumers soon. The price increase will be across the board – even for offline retail as, for many of the categories, the supply chain is concentrated in China or is tightly integrated.

Chinese e-commerce platforms, as well as traditional American retailers in Walmart, will have limited room to squeeze supplier margins further. Raising prices would be inevitable. Shein and Temu have already been seeing a drop in US sales since February.

There are plenty of historical examples of large communities or whole societies living in enclosed, economically inefficient systems, who find ways to justify their status as “normal”. We hope we do not have to get there.

The problem for everyone now is the uncertainty. Nobody can place all their bets wholly on the permanence of the Trump tariffs, or the US system’s ability to quickly correct the excess.

Many have chosen not to make any drastic change – trying to hang on through this turbulence first without being shaken off the wagon. Same for Shein, Temu and other Chinese businesses that have been in the international arena.

Two weeks ago, we ran a survey with our community of Chinese businesses on how they view the impact of tariffs. Close to 43 per cent of over 2,000 respondents chose a passive attitude, believing that Chinese businesses will be targeted wherever they go; 32 per cent opted to “wait and see” because things might change very soon; while about 21 per cent preferred to “stop wishful thinking, and face it head on”.

Yet, all these options are not mutually exclusive.

In our chatter with manufacturers and suppliers across different industry clusters in China, surprisingly, many have chosen to trust the (Chinese) government this time.

“There will be pain, but we have been through a lot of pain in the past. Eat bitterness, you know,” one manufacturing boss in Eastern Zhejiang province told us. “In the long term, we might prevail, but definitely we will survive.”

Jianggan Li is CEO of Momentum Works, a Singapore-based venture outfit, and co-author of Seeing The Unseen: Behind Chinese Tech Giants’ Global Venturing.