analysis East Asia

Can a pivot back home help bail out tariff-hit Chinese exporters?

In addition to recent new laws and state incentives, Chinese tech and retail giants have been stepping up support for exporters,┬Āsuch as┬Āintroducing measures to sell┬Āmore┬Āgoods on their platforms.

People visit a booth during the China Import and Export Fair on Apr 15, 2025. (REUTERS/Tingshu Wang)

This audio is generated by an AI tool.

SINGAPORE: It was once hailed as China's answer to AppleŌĆÖs Beats Electronics - offering sleek yet affordable high-quality audio devices that appealed to a growing young, tech-savvy global customer base.┬Ā

But even after global sales of up to 300 million units, Chinese electronics audio company 1MORE is now shifting gears - redirecting more of its sales to the domestic Chinese market as US-China tensions continue to escalate amid a bitter tariff tiff.

It has teamed up with one of ChinaŌĆÖs largest e-commerce platforms JD.com to market and promote its products - a move which analysts have noted is part of a wider trend that comes at a time when consumer confidence continues to hover near historic lows and government efforts to boost domestic spending have not been widely successful.

But 1MORE remains confident about its strategy.┬Ā

ŌĆ£Joining JD.com has not only helped 1MORE leverage the platformŌĆÖs reach to boost sales and brand awareness, it has also showcased the quality and technological strength of (our) products,ŌĆØ said Cai Yunhui, the groupŌĆÖs chief operating officer, adding that sales on the platform had grown by nearly 20 per cent in the past two weeks.

ŌĆ£Since 1MORE products have always maintained the same standards for both domestic and overseas markets, no changes were needed for products shifting to domestic sales.ŌĆØ

SUPPORTING TARIFF-HIT BUSINESSES

The US-China trade conflict has reignited with renewed intensity, plunging the two superpowers into a new phase of global economic uncertainty.

Since his return to the White House in January, US President Donald Trump has imposed additional tariffs as high as 145 per cent on Chinese imports - prompting Beijing to hit back with tariffs of up to 125 per cent on US goods.

Official trade talks have yet to take place but China has granted tariff exemptions on select products, reportedly listing US-made products that would be exempted - an approach observers said would allow Beijing to maintain its public messaging while privately taking practical steps to provide concessions.

Beijing has urged exporters to pivot to its massive domestic market, by announcing plans and incentives to help tariff-hit firms and businesses mitigate risks.┬Ā

Due to take effect on May 20, the recently-passed Private Economy Promotion Law is said to include provisions on fair competition, access to investment and financing and rights protections.

On the ground, Chinese tech and retail giants have also been stepping up efforts to support exporters squeezed by US tariffs.

As part of a 200 billion yuan (US$27.6 billion) initiative announced on Apr 11, JD.com pledged to help exporters sell their products domestically over the next year.┬Ā

Employees will be sent to Chinese companies involved in foreign trade, directly purchase their ŌĆ£high-quality productsŌĆØ and set up dedicated sections on its e-commerce platform to sell these products and direct traffic and marketing support.┬Ā

The company is also hoping for more support in other overseas markets if US-China trade tensions continue to persist, Cai said.

ŌĆ£We also hope to see more domestic exhibition subsidies and government procurement projects extended to support private enterprises,ŌĆØ she added.

Rival Alibaba also announced special support programmes through its popular online retail sites Taobao and Tmall, as well as high-tech supermarket chain Freshippo, which rolled out a fast-track onboarding process, providing 24/7 support and simplified approvals for tariff-hit exporters.

A new ŌĆ£Export-to-DomesticŌĆØ section in its apps will boost visibility for Chinese-made goods.┬Ā

PDD Holdings, which operates the popular Pinduoduo Chinese shopping app, has also pledged to invest 100 billion yuan over the next three years to support smaller exporters, including subsidies for small- and medium-size enterprises (SMEs) in cross-border e-commerce operations to help stabilise production and navigate overseas challenges.

Chinese supermarket giant Yonghui Superstores, which operates over 926 stores across 28 provinces selling agricultural products, processed foods and household appliances, has called on affected manufacturers to join its ŌĆ£green channel initiativeŌĆØ aimed at supporting domestic supply chain enterprises grappling with stockpiles caused by export challenges.┬Ā

Speaking to Chinese state media outlets, the company said it was also currently in talks with over 70 Chinese supply chain enterprises, including those supplying products to US competitors, like Costco and Walmart.┬Ā

In a state media interview published on Apr 14, Cao Derong, President of the China Chamber of Commerce for Import and Export of Foodstuffs, Native Produce and Animal By-products (CFNA), said greater attention and support from authorities would be needed to ensure a smooth transition for Chinese export companies hoping to successfully pivot to the domestic market.┬Ā

ŌĆ£This requires the relevant domestic departments to pay greater attention and provide further support, so that the transition can be smooth,ŌĆØ Cao said.┬Ā

CHALLENGES OF ŌĆ£PIVOTING INWARDSŌĆØ ┬Ā

Even with incentives and extensive support, analysts have continued to express doubt over ChinaŌĆÖs massive domestic market being able to ease the burden faced by exporters.

One, pre-existing issues like still-struggling growth and consumption rates and increasing spending power would take time to resolve, analysts told ┬ķČ╣.┬Ā

ŌĆ£Without higher income levels, these remain just (empty) slogans,ŌĆØ said Liu Zhibiao, professor and director of the Yangtze Industrial Economic at Nanjing University.┬Ā

ŌĆ£To solve this, we need to raise the share of national income allocated to households, improve disposable income and strengthen the social safety net - only then can a domestic-demand-led growth strategy become a reality.ŌĆØ

Persistent overcapacity also remains a key economic barrier for businesses trying to shift exports inward, said Liu.

ŌĆ£Many factories are already running well below capacity. If supply keeps outpacing demand, itŌĆÖs hard for the domestic market to absorb more,ŌĆØ he said, adding that many overseas export-reliant Chinese firms still lacked the experience of being able to operate domestically.┬Ā

ŌĆ£Their sales channels, marketing methods and payment systems were built for overseas markets and wonŌĆÖt easily translate at home.ŌĆØ┬Ā

He also noted that many goods intended for US markets would not likely translate or appeal to ChinaŌĆÖs domestic buyers. ŌĆ£Lawnmowers, produced specifically for the US, are one such example,ŌĆØ he said.┬Ā

ŌĆ£This mismatch between supply and demand makes it difficult to make the switch.ŌĆØ

Chinese companies, long part of the global value and supply chains, would also likely face additional challenges in pivoting towards domestic consumers, Liu said, even with strong and efficient manufacturing systems and capabilities.

ŌĆ£They may have strong manufacturing capabilities but what (branding and image) will they sell under? They cannot use the brands of the multinational corporations they used to work for. Intellectual property issues could also arise,ŌĆØ he said. ┬Ā

ŌĆ£Once they lose guidance and support (traditionally) provided by these global multinational companies, many of them will struggle to compete in the domestic Chinese market.ŌĆØ

Dr Chong Ja Ian, an associate political science professor at the National University of Singapore (NUS), noted a critical point: that overall consumer confidence in the country remained at record lows.

ŌĆ£The Chinese market has not been consuming much for some time (and) efforts over the years to boost consumer spending have not been all that successful,ŌĆØ Dr Chong said.┬Ā

He added that sectors like e-commerce platforms, low-cost electronics, apparel and supermarkets could support the switch.┬Ā

ŌĆ£These might find it easier to make a switch even if domestic consumption is low but that may not be enough to boost the economy,ŌĆØ he said.┬Ā

Pivoting inwards might be ŌĆ£a painkillerŌĆØ for ChinaŌĆÖs current economic woes but it would not likely solve the bigger ŌĆ£underlying problem of excess capacity exacerbated by tariffsŌĆØ, said Gary Ng, a senior economist at Natixis, adding not all products catering to overseas markets would be suitable for Chinese consumers.┬Ā

ŌĆ£Sectors with high overseas market reliance, such as textiles, toys, and renewables, will be hit the hardest,ŌĆØ Ng said.┬Ā

ŌĆ£Some of these may heavily rely on overseas markets for existing revenue or new growth and China would not have sufficient demand to absorb the losses.ŌĆØ┬Ā

He added that it would not be easy for China to scale back on its role as the worldŌĆÖs largest manufacturing hub.┬Ā

ŌĆ£If Chinese exporters turn inward for demand, it will escalate price war with business closure and consolidation within the industries,ŌĆØ said Ng, also a research fellow at the Central European Institute of Asian Studies (CEIAS).

ŌĆ£(They) can try to sell more to alternative markets, but it is also possible it will see backlash if it threatens the local industries of other countries.ŌĆØ┬Ā

LOOKING TO NEW MARKETS┬Ā

This explains why some Chinese firms are stepping up or pushing ahead with expanding into regional markets as part of diversification.

For instance, Togran Electronic Technology, a Guangdong-based maker of gaming keyboards, mice and headsets, told ┬ķČ╣ that it had been making plans ŌĆ£as early as 2018ŌĆØ to expand into other markets.

This year, it launched its first overseas factory in Vietnam ahead of US tariffs.┬Ā

ŌĆ£We made a global layout in advance, including setting up our own plant in Vietnam so while thereŌĆÖs still some impact, itŌĆÖs relatively limited,ŌĆØ a company spokesperson told ┬ķČ╣, adding that it was also eyeing new markets like African nations and Singapore as part of a wider global expansion strategy.

Leading Chinese AI and voice-recognition technology firm iFLYTEK is planning to scale back its US presence due to rising trade tensions and will also focus on brand-building in new markets like Japan, South Korea, Southeast Asia, the Middle East and Europe.┬Ā

ŌĆ£In these markets, we focus on growing our brand first and let the business follow gradually,ŌĆØ said iFLYTEK Vice President Vincent Zhan, who added that exports to North American markets would not be cut entirely but would be adjusted based on break-even viability.

ŌĆ£We are reducing investment and market integration efforts there,ŌĆØ Zhan said.┬Ā

ŌĆ£ThereŌĆÖs too much uncertainty to make major moves.ŌĆØ

Other non-exporting companies are also fearing consequences.┬Ā

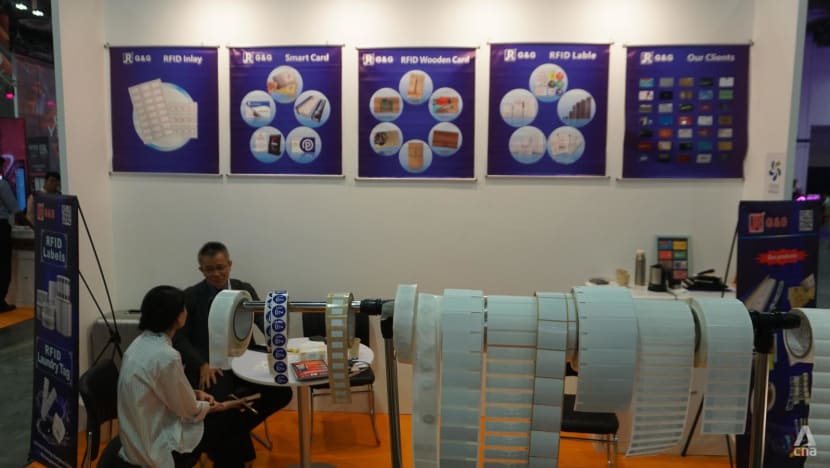

ŌĆ£We are expecting a ripple effect soon,ŌĆØ said Gary Su, a sales manager at G&G Smart Technology, a leading Guangzhou-based manufacturer of smart cards and other radio frequency identification (RFID) technology.┬Ā

The US might account for less than 2 per cent of overall sales but the firm is still bracing for spillover effects. ŌĆ£Even if weŌĆÖre not hit directly, the impact will ripple through in a few months,ŌĆØ Su said.┬Ā

More exporters are now looking to regional markets as competition will inevitably intensify, Liu said. ŌĆ£To survive, they will need to explore other markets and some might turn their back on ChinaŌĆÖs own domestic market, which increases pressure across the board.ŌĆØ

ŌĆ£For now, we are adopting a wait-and-see approach,ŌĆØ Su said. ŌĆ£We are staying active, joining exhibitions and expanding into new markets but also watching closely how global dynamics unfold.ŌĆØ

Turning to new global markets like India, Southeast Asia and the Middle East could be a solution, experts said, but it would need to be backed by real integration.

ŌĆ£China will need to deepen ties with non-US markets,ŌĆØ Liu said. ŌĆ£Without stronger alliances and integration with these economies, the potential of non-US markets canŌĆÖt be fully unlocked and excess capacity may turn into inefficient growth.ŌĆØ┬Ā

Xu Tianchen, a senior economist at the Economist Intelligence Unit (EIU), told ┬ķČ╣ that China had already been diversifying trade with the Global South.

ŌĆ£Diversion via third countries is an option, and I donŌĆÖt think the US will have the capacity to block transshipment,ŌĆØ Xu added. ŌĆ£Even if the US were to crack down on ASEAN, trade would still readily flow to new rerouting hubs such as Latin America and the Middle East.ŌĆØ

ŌĆ£Direct trade to the US will recover at some stage as sky-high tariff rates between China and the US are unsustainable and will eventually be walked back.ŌĆØ