FAQ: What you need to know about upcoming changes to Integrated Shield Plan riders

How are new riders different from current ones? What does it mean for your out-of-pocket costs?

Illustration of medical check-up conducted at a hospital. (Photo: iStock/Chinnapong)

This audio is generated by an AI tool.

SINGAPORE: The Ministry of Health (MOH) announced on Wednesday (Nov 26) new rules for insurance plans to curb rising private healthcare costs.

These changes will affect Integrated Shield Plan riders ‚Äď private insurance add-ons that complement MediShield Life to cover the fees for higher hospital wards or private healthcare.

I already have a rider. How is the new version different?

From Apr 1, 2026, new riders will no longer be allowed to cover the minimum deductible, which is the amount policyholders must pay each policy year before insurance kicks in.

In addition, the annual co-payment cap for new riders will increase from S$3,000 (US$2,300) to S$6,000. The 5 per cent co-payment requirement remains unchanged and policyholders can still use MediSave to pay for deductibles and co-payments.

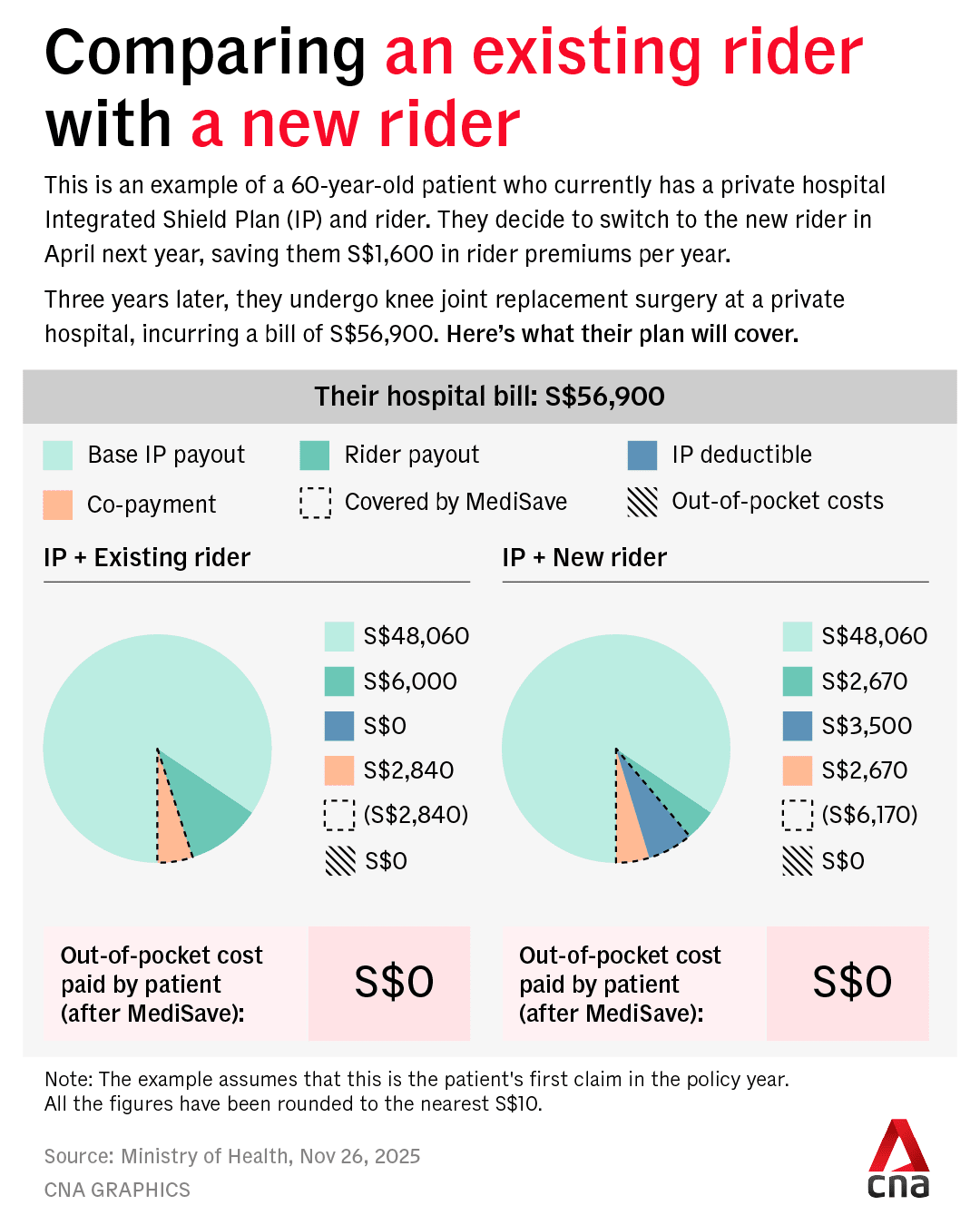

To illustrate how the new requirements work, let’s take the example of a 60-year-old patient named Patrick. He currently has a private hospital Integrated Shield Plan and rider, but decides to switch to the new rider in April next year, saving him S$1,600 in rider premiums per year.

Three years later, he undergoes knee joint replacement surgery at a private hospital, incurring a bill of S$56,900.

As a private hospital patient, he has to pay S$3,500 in deductibles.

After deducting this sum from the total, the 5 per cent co-pay cap means Patrick also has to fork out 5 per cent of S$53,400, which is S$2,670.

His base Integrated Shield Plan will cover S$48,060. For the deductibles and co-payment, Patrick has to pay a sum of S$6,170, which can be fully covered by MediSave, resulting in no out-of-pocket costs.

If he had chosen to stick with his existing rider, it would have covered the S$3,500 in deductibles. He would receive about S$6,000 in rider payouts, which is 95 per cent of the total bill after deducting what his base payout will cover.

From his total bill of S$56,900, the 5 per cent cap means Patrick needs to co-pay about S$2,840, which can also be fully covered by MediSave, resulting in no out-of-pocket costs.

However, by switching to the new rider, Patrick had already saved S$4,800 of rider premiums in cash over the last three years.

I don’t have a rider. What happens if I buy one next year?

With these changes, Singaporeans can expect the new riders to be ‚Äúmuch more affordable‚ÄĚ compared to those currently on the market, said MOH.

The premiums of the new riders are expected to be about 30 per cent lower than the existing ones that have maximum coverage. This translates to annual savings of about S$600 for policyholders with riders for private hospital coverage and about S$200 for those with riders that cover public hospitals.

Riders with ‚Äúmaximum coverage‚ÄĚ currently refer to those that cover the minimum S$3,000 co-payment cap while fulfilling the minimum 5 per cent co-payment requirement. Two-thirds of policyholders have riders with maximum coverage, MOH said.

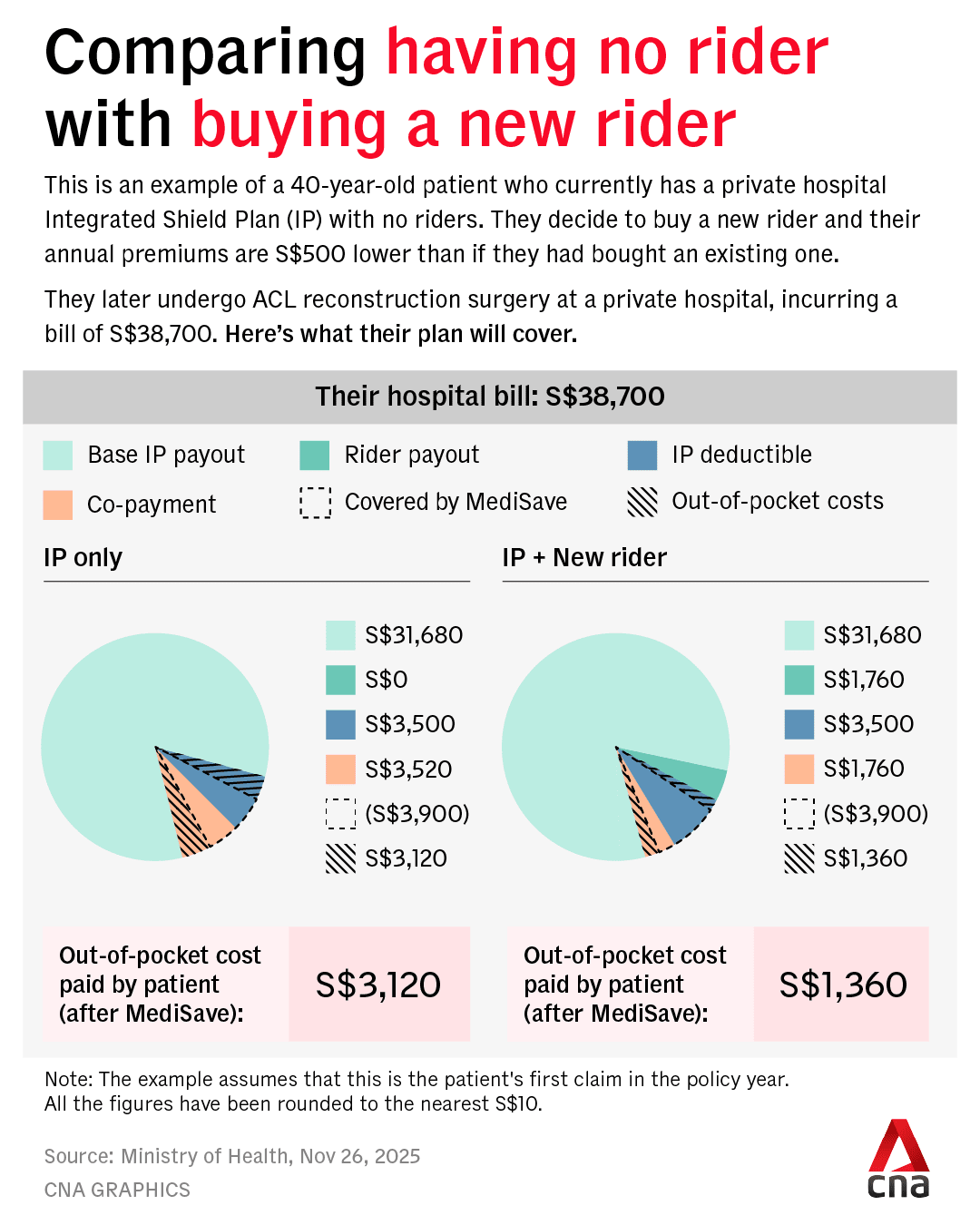

Let’s use the example of Bonnie, who is 40 years old this year. She currently has a private hospital Integrated Shield Plan with no riders, and decides to buy a new rider in April 2026. Her annual premiums are S$500 less than if she had bought an existing one.

Later, she undergoes an anterior cruciate ligament reconstruction surgery at a private hospital and is presented with a bill of S$38,700.

Like Patrick, Bonnie has to pay S$3,500 in deductibles as a private hospital patient.

Deducting this from her total hospital bill, the co-payment cap means she also has to pay 5 per cent of S$35,200, or S$1,760. Her base payout covers S$31,680 of the bill.

Of the total S$5,260 she has to pay, S$3,900 can be covered by Medisave, leaving her with a total of S$1,360 in out-of-pocket costs.

If she had not bought a rider, she would have had to pay S$3,500 in deductibles, alongside a 10 per cent co-insurance sum of S$3,520.

With S$3,900 covered by MediSave, this would have brought her out-of-pocket costs to S$3,120.

When will these changes kick in?

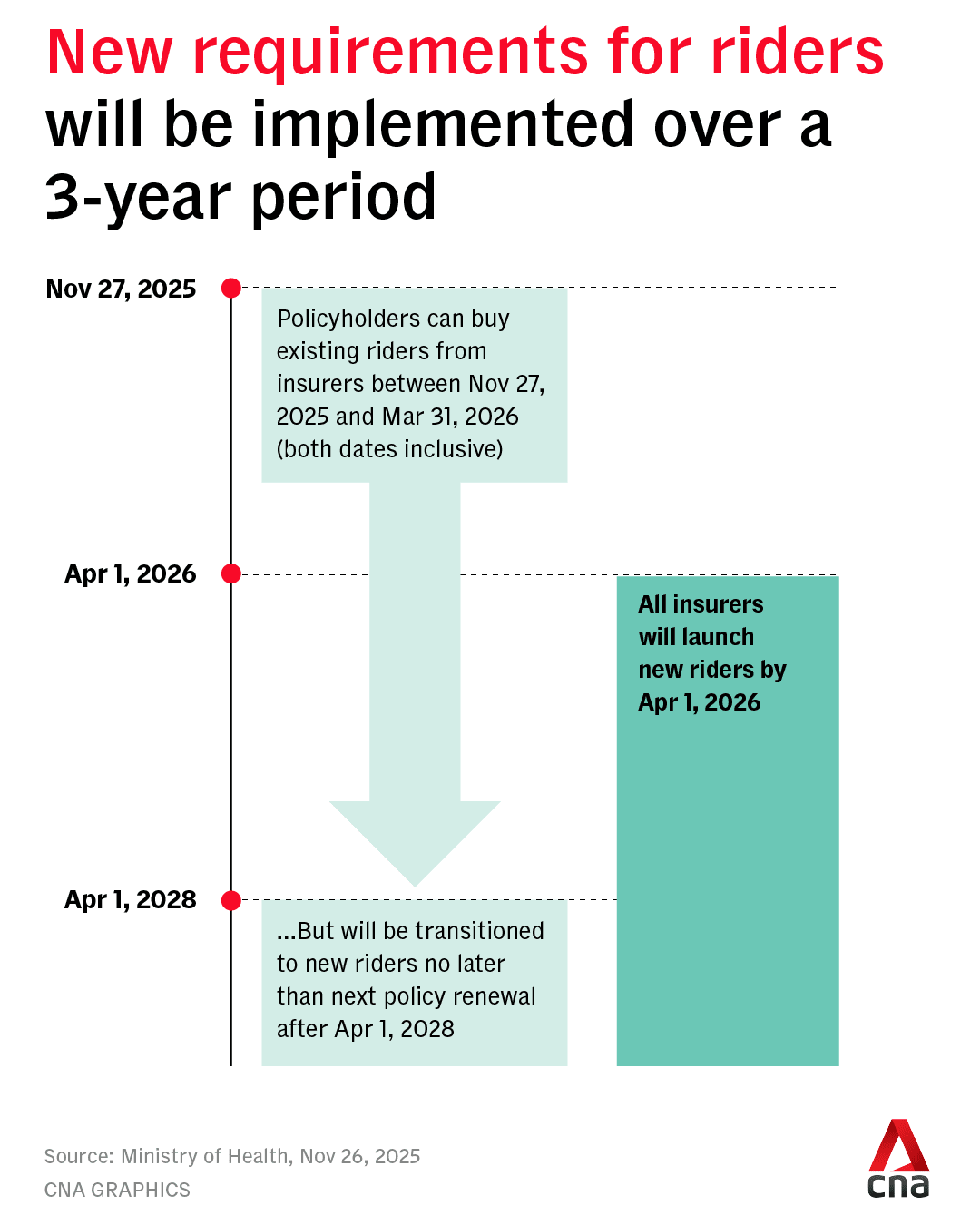

Insurers will launch the new riders that comply with the revised requirements by Apr 1, 2026, and stop selling non-compliant riders on the same day.

They can continue selling the existing riders until Mar 31, 2026, but must inform those who purchase them that they will transition to riders that meet the new requirements no later than their next policy renewal after Apr 1, 2028.

As for existing rider policies, insurers will ‚Äúfurther study‚ÄĚ and ‚Äúdetermine their own approach‚ÄĚ, said MOH, encouraging policyholders who bought riders before Nov 27 to consult their financial advisers about whether the new ones would better suit their needs.

When asked whether there may be insurers who do not change the terms for existing policyholders, MOH acknowledged that there is a chance that not all insurers would do so.

‚ÄúBut they will study the approach and we‚Äôll leave them to it. And we will implement the requirements for the new rider holders,‚ÄĚ said MOH.

‚ÄúIf they don‚Äôt change and only the new rider policyholders are on the new riders ‚Ķ then the impact on cost will have to take a much longer time because you would only see the change in behaviour when the new rider holders are actually claiming.‚ÄĚ

Why are these changes being introduced?

About 71 per cent of Singapore residents, or about 3 million people, have Integrated Shield Plans. Of these policyholders, 67 per cent ‚Äď or about 2 million people ‚Äď have riders.

Five in 10 Integrated Shield Plan policyholders are on plans for private hospitals, and 80 per cent of this group have riders.

While very comprehensive coverage that ‚Äúprotects up to almost the last dollar‚ÄĚ can ‚Äúconfer absolute peace of mind‚ÄĚ, this can be very expensive and drives up healthcare costs, said the Health Ministry.

With minimal co-payment, there is a greater tendency for patients to overconsume healthcare services and for healthcare providers to overservice them, it added.

According to MOH data, private hospital Integrated Shield Plan policyholders with riders are 1.4 times as likely to make a claim as those without them, with an average claim size of 1.4 times.

Private hospital bills have risen steeply, and Integrated Shield Plan and rider claims have been escalating, said MOH, adding that the median bill size in 2024 was S$15,700, up from S$9,100 in 2019.

Insurers have been raising premiums of private hospital plans and riders significantly to keep up with claims, said the ministry. Despite these moves, four of seven Integrated Shield Plan insurers reported losses of 9 per cent to 48 per cent in 2024, while the remaining three ‚Äúbarely broke even‚ÄĚ.

‚ÄúThese changes will help to bring health insurance back to its original objective, which is to protect patients against larger healthcare bills,‚ÄĚ said MOH.

‚ÄúIt will increase cost discipline over minor episodes, and reduce overservicing and overconsumption associated with non-essential hospital admissions or treatments.‚ÄĚ