US is biggest recipient of Chinese loans as Beijing shifts focus to rich nations, new study reveals

Liquefied natural gas developments, data centres and new airport terminals are among the major US infrastructure projects bankrolled by Chinese state-owned entities.

A new study has found that Chinaβs overseas lending portfolio is far larger than previously understood.

This audio is generated by an AI tool.

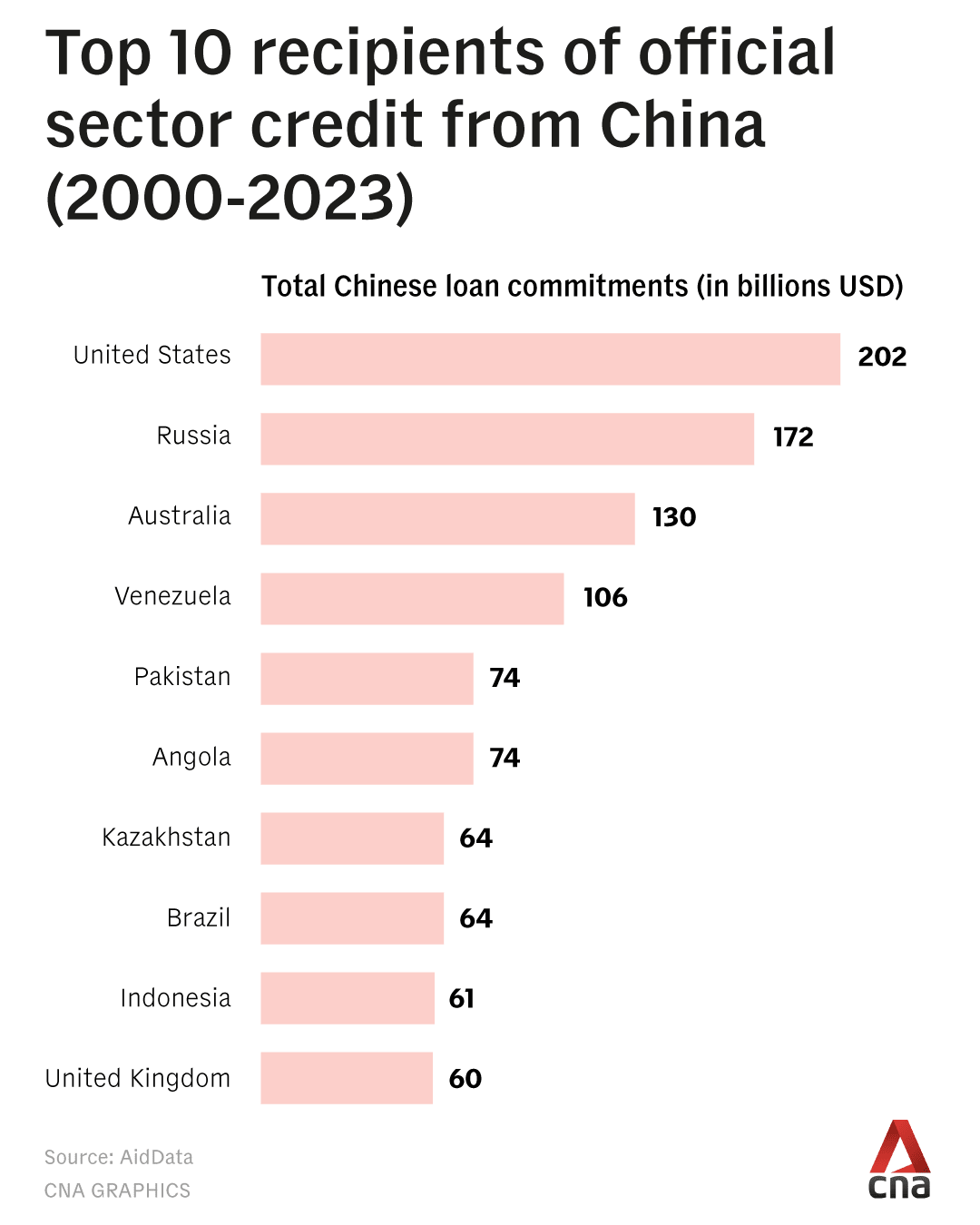

WASHINGTON: The United States has become the worldβs largest recipient of Chinese loans, despite years of warning other nations about the risks of borrowing heavily from China, a new study tracking Beijing's credit activities has found.

A report by AidData, a research lab at the College of William & Mary in Virginia, showed that over the course of nearly 25 years, US companies received more than US$200 billion in Chinese financing, including in key sectors such as semiconductors and infrastructure.

The report, published earlier this month, revealed a broader shift in Chinaβs lending strategy β moving away from developing nations toward high-income economies, according to the study.

SHIFT IN CHINAβS LENDING

Liquefied natural gas developments in Texas and Louisiana, data centres in northern Virginia, and new terminals at New Yorkβs John F Kennedy International Airport and Los Angeles International Airport are among the critical infrastructure projects bankrolled by Chinese state-owned entities.

According to AidData, Beijing has also helped Chinese firms acquire or buy stakes in high-tech US companies and provided liquidity to a wide range of Fortune 500 companies including Amazon, Tesla and Boeing.

Brad Parks, executive director at AidData, said: βWe're talking about lending into sectors that have been designated as sensitive on national security grounds.β

These industries include artificial intelligence, defence production, quantum computing, biotechnology, robotics and semiconductors, he noted.

Parks added that Chinese state lenders often avoided scrutiny by channelling funds through offshore shell companies in jurisdictions such as Bermuda, or by routing the money through international bank syndicates.

But it is not just the US receiving Chinese loans.

China's lending and grant giving totalled US$2.2 trillion across 200 countries in every region of the world from 2000 to 2023, said the report.

It noted that in 72 high-income countries alone, China financed nearly 10,000 projects and activities over that period, with spending approaching US$1 trillion.

βI think everyone previously assumed that China's lending operations in wealthy industrialised countries were small and insignificant, but we discovered the opposite to be true,β said Parks, who is also a research professor at the College of William & Mary.

βThe share of Beijing's lending portfolio that supports high-income and upper middle-income countries has skyrocketed from 12 to 76 per cent.β

The study found that Chinaβs overseas lending portfolio is far larger than previously understood. Its lending for Belt and Road infrastructure projects in the developing world makes up a surprisingly small share β just 20 per cent of the total.

CHINAβS EXPANDING INFLUENCE

China remains the world's largest official creditor, said the AidData report.

It has effectively become the new global pace-setter, reshaping the rules and norms that govern the cross-border provision of aid and credit.

AidDataβs research said that shift accelerated after Beijing rolled out its ambitious βMade in China 2025β master plan a decade ago to transform the country into a self-sufficient, high-tech manufacturing powerhouse β prioritising key sectors like semiconductors, biotech and quantum computing.

William Henagan, a former White House investment adviser, said the acquisitions present risks including collection of sensitive intelligence, control over critical infrastructure and an unfair competitive advantage in Chinaβs favour.

The research fellow at the Council on Foreign Relations, an American think tank, said western governments have traditionally lacked the deep financial expertise needed to catch this kind of statecraft.

But Henagan said screening in the US has gotten better in the last decade.

βI think frankly the most important type of risk is at a certain point, economic competitiveness and security risk is going to ultimately determine the long-run trajectory and success of one nation versus the other,β the US industrial policy expert noted.

βWhen two nuclear powers are competing with one another, conflict is going to play out in the field of economics or technology, not necessarily on the battlefield.β

AidData said that many of Chinaβs lending operations in the US were guided by the pursuit of profit rather than geopolitical or geo-economic advantages.

Chinaβs Ministry of Foreign Affairs, responding to a request for comment on the report, told Reuters that its overseas investment and financing "adhered to international practices, market principles and the principle of debt sustainability".